4.2 How Does Fundamental Analysis help you make trading decision

In the previous lesson, we learned about the important classifications and specific contents of Forex fundamental analysis. So, how do we apply fundamental analysis to make trading decisions?

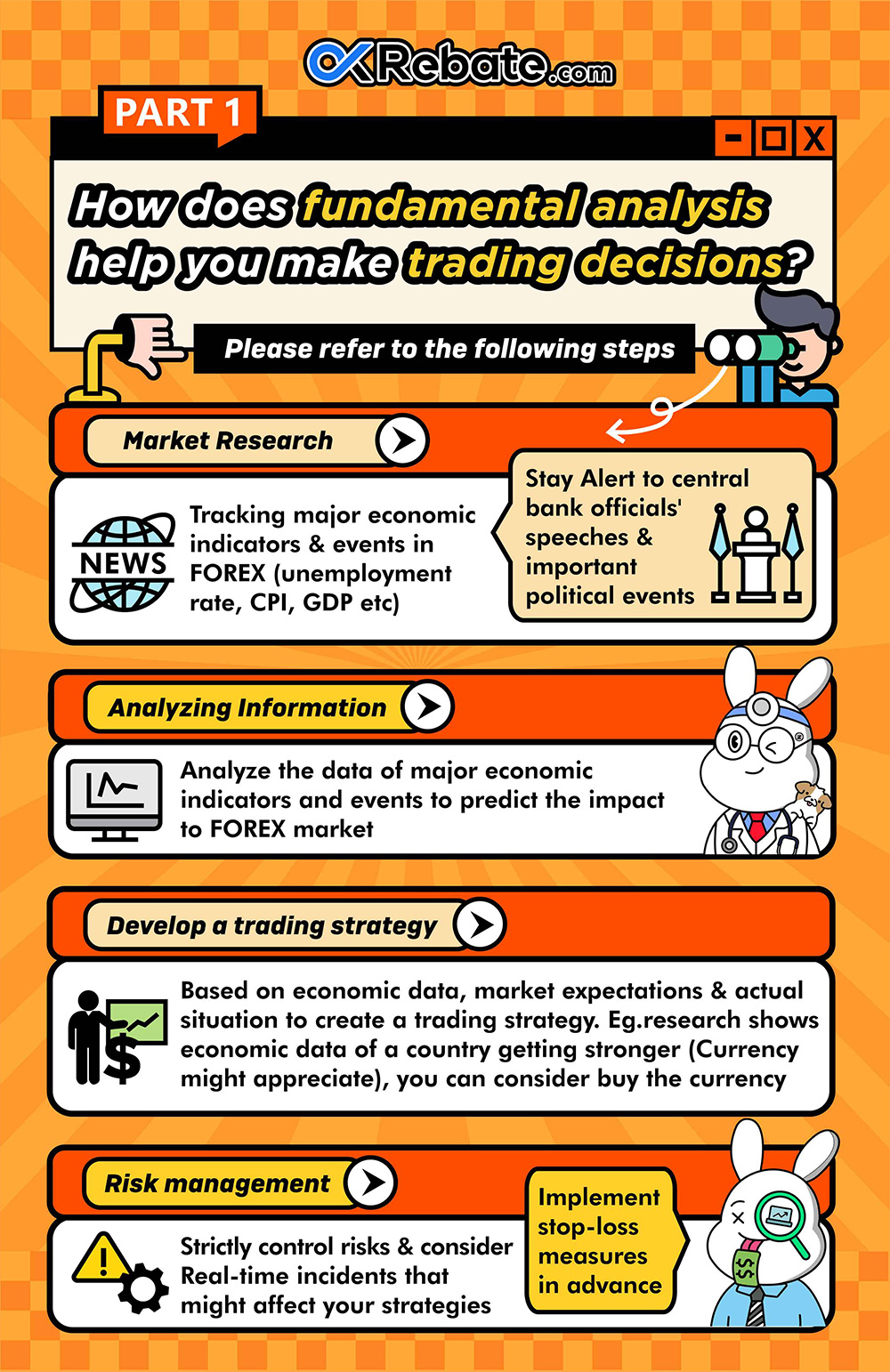

The steps to make trading decisions based on fundamental analysis are roughly as follows:

Market Monitoring:

First, we need to understand the key economic indicators and events that the Forex market is currently focused on (as discussed in the previous lesson), such as unemployment rates, CPI, GDP, and central bank officials’ speeches, among others. Develop a habit of staying updated on market dynamics and news related to various aspects like politics, economics, and society to understand market sentiment and expectations.

Data Analysis:

Analyze the data from important economic indicators and events to understand their impact on Forex market trends. It’s essential to note that different indicators and events have different effects on various Forex currencies.

Develop a Trading Strategy:

Based on economic data, market expectations, and the actual situation, formulate a Forex trading strategy. For example, if a country’s economic data is strong, it may lead to the appreciation of its currency, so you may consider buying that currency. Additionally, if the market expects a central bank to raise interest rates, it may trigger currency appreciation, and you might consider buying that currency.

Risk Management: During trading, strictly follow risk control and money management rules. Avoid reckless trading and be prepared to consider stop-loss measures if the actual situation diverges from your trading strategy.

Let’s look at a practical application:

Suppose we want to use fundamental analysis to assess the trend of the Euro against the US Dollar.

We can monitor the GDP growth rate, inflation rate, employment market data, etc., of the Eurozone and the United States. If the economic data for the Eurozone is strong while the United States’ data is weak, it might lead to an increase in the Euro-to-US Dollar exchange rate.

Alternatively, we can monitor the monetary policies of the European Central Bank (ECB) and the Federal Reserve (Fed). If the ECB hints at an interest rate hike while the Fed shows no signs of raising rates, it could lead to an increase in the Euro-to-US Dollar exchange rate.

What are the Drawbacks and Risks of Forex Fundamental Analysis?

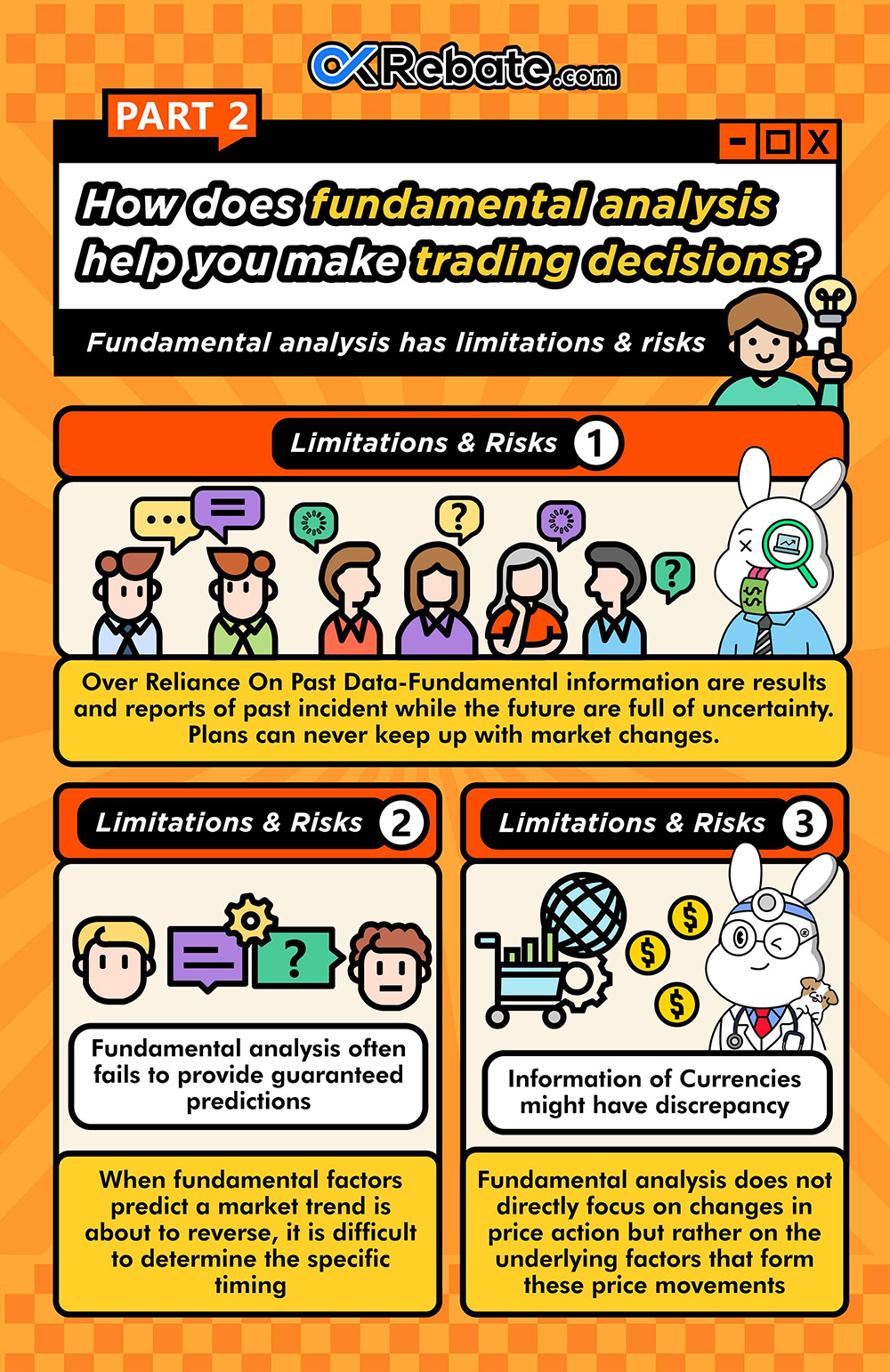

Fundamental analysis also has its drawbacks and risks, and it cannot perfectly predict market movements.

The limitations of fundamental analysis include:

Delayed Information: Most investors typically receive fundamental information after the fact, making it challenging to keep up with market price changes. Fundamental factors often become lagging information when reported by government agencies or news organizations, and by then, market trends may have already occurred.

Timing Issues: Fundamental analysis often struggles with the issue of timing. For instance, while fundamental factors may indicate that a market trend will reverse in the future, it can be challenging to pinpoint exactly when this will happen.

Focus on Underlying Factors: Fundamental analysis doesn’t directly focus on changes in price actions but rather emphasizes the underlying factors driving these price actions. Therefore, its primary purpose is to explain why a previous trend occurred. These reasons can affect currency supply and demand and exchange rate levels.

However, this doesn’t mean that fundamental analysis is unimportant. Every analytical method has its shortcomings, whether it’s technical or fundamental analysis. To become a proficient trader, it’s essential to use these analytical tools effectively.

Fundamental information often alerts traders to what they need to watch out for, especially concerning a country’s monetary policies or significant economic events. This helps traders prepare for impending changes and avoid being caught off guard by sudden trend reversals.

In conclusion, while price fluctuations may be influenced by fundamental factors, fundamental analysis primarily focuses on long-term trends rather than short-term price movements. Therefore, it is particularly useful for formulating long-term investment strategies and is generally less suited for short-term trading. Although Forex fundamental analysis has some drawbacks and risks, it typically provides a reference for trend analysis for long-term investors or experienced traders, helping them make more informed trading decisions.