3.1 Common forex term

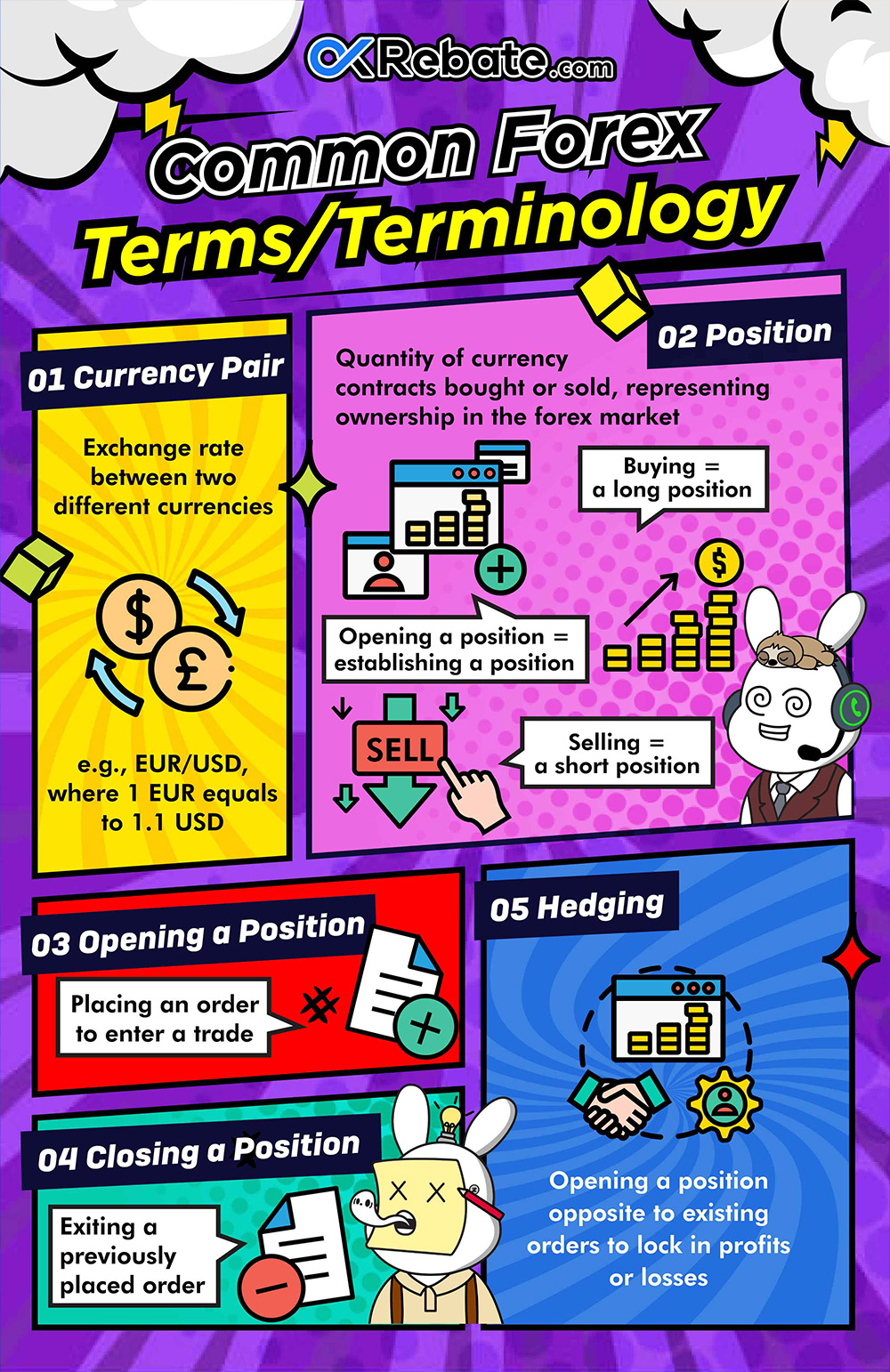

1.Currency Pair:

A currency pair represents the exchange rate between two different currencies. For example, the exchange rate for EUR/USD is 1.1000, which means 1 EUR can be exchanged for 1.1 USD.

2.Position:

Position is a common term for funds and assets. In the forex industry, a position refers to the quantity of forex contracts bought or sold.

Opening a position is known as establishing a position.

Buying is referred to as taking a long position.

Selling is referred to as taking a short position.

3.Opening:

Also known as opening a trade or placing an order.

4.Closing:

Refers to closing a previously placed order.

5.Hedging:

When there are open, unclosed orders, simultaneously opening a position opposite to the existing orders and not closing it within a certain time frame to lock in current profits or losses.

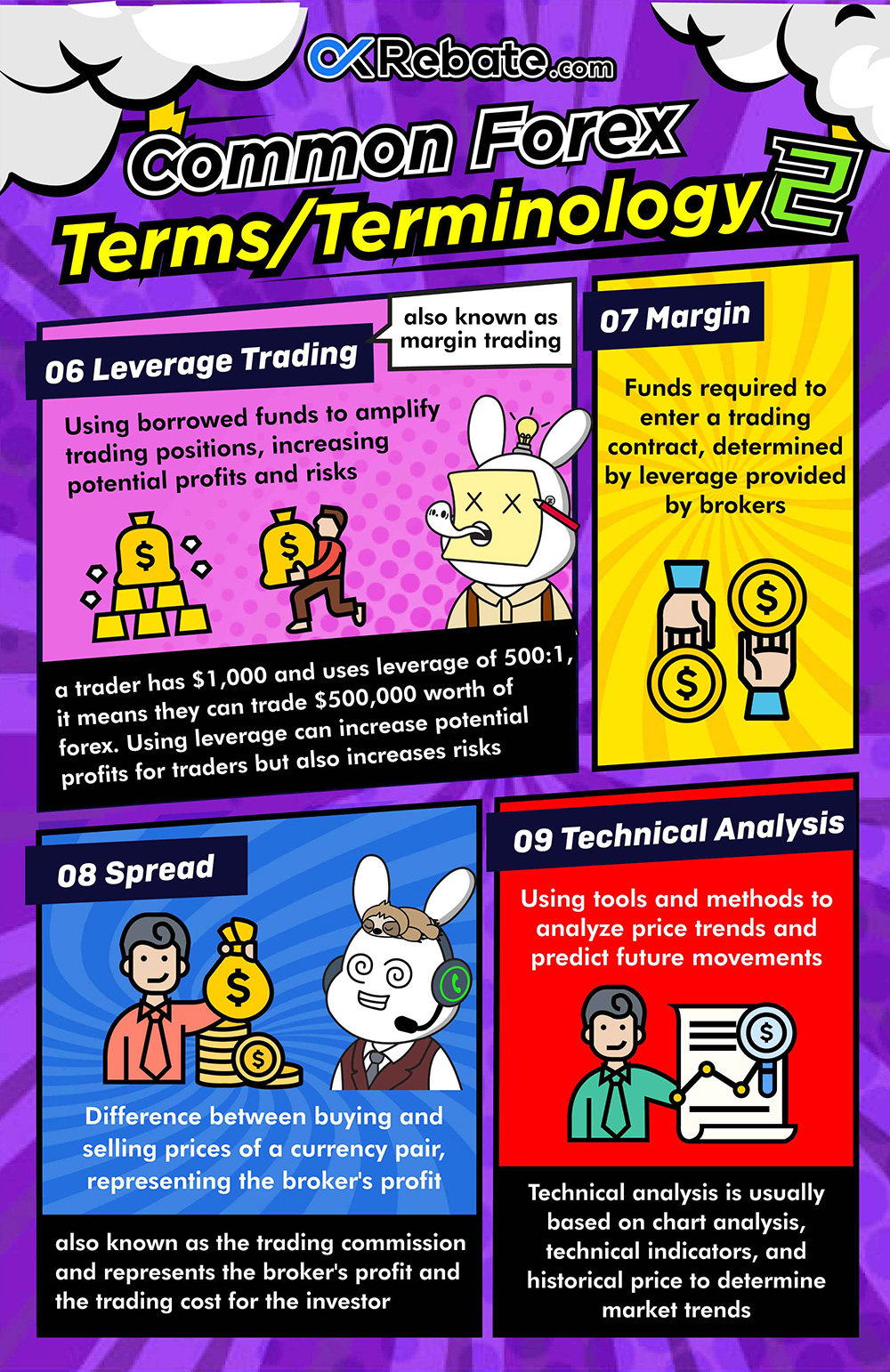

6.Leverage Trading:

Leverage trading, also known as margin trading, involves investors using their own capital as collateral to amplify their forex trades, essentially increasing their trading capital. The level of leverage is generally determined by the broker or financial institution and determines how much capital a client needs to put up. For example, a trader has $1,000 in capital and uses 500x leverage. This means they can trade $500,000 worth of forex. Using leverage can increase potential profits but also raises the level of risk, making it a double-edged sword.

7.Margin:

Margin in forex trading refers to the amount of capital required by an investor to enter into a forex contract. The specific margin requirement depends on the leverage offered by the broker. For example, trading 1 standard lot of EUR/USD may require a capital of 100,000 EUR, but with 500x leverage, only 200 EUR may be needed as margin.

8.Spread:

The spread is the difference between the buy (bid) and sell (ask) prices of a currency pair. It’s also known as the trading fee and represents the broker’s profit while being a trading cost for investors.

9.Technical Analysis:

Technical analysis refers to a set of tools and methods used to evaluate market price trends and forecast future price movements in securities or forex trading. It typically relies on chart analysis, technical indicators, and historical price data to determine market trends. Different technical analysis tools and methods have their limitations, so traders often use multiple tools and methods to ensure more accurate trading decisions. Technical analysis is often considered for short-term price predictions, but some investors use it for long-term trend analysis.

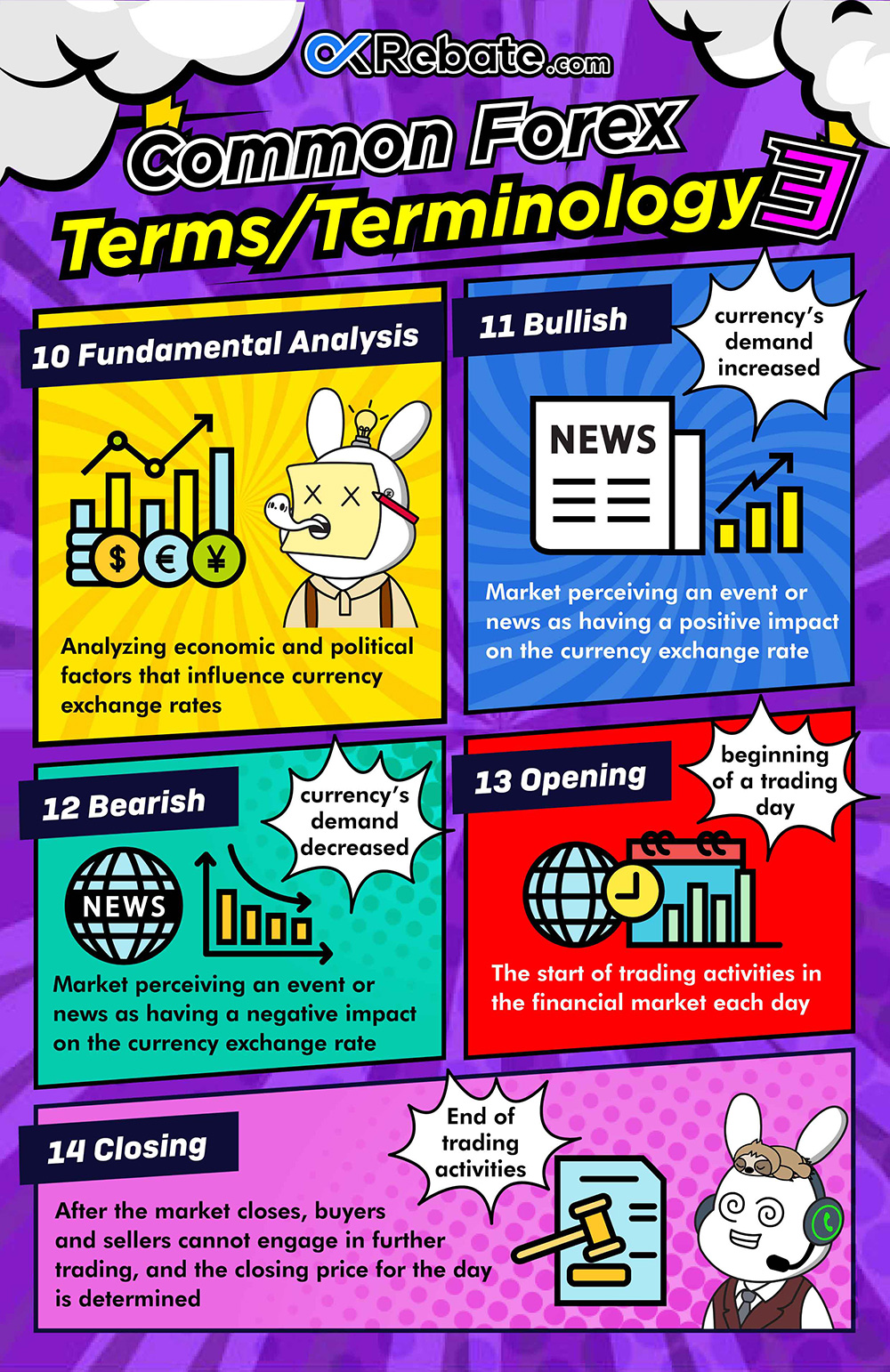

10.Fundamental Analysis:

Forex fundamental analysis focuses on the basic economic and political factors that influence the exchange rate of a country’s currency. It is a crucial factor in analyzing and predicting currency movements. Fundamental factors include economic data, central bank interest rate changes, political events, and geopolitical risks. These factors impact the supply and demand of a nation’s currency, thus affecting its exchange rate. Understanding fundamental analysis helps traders make more informed trading decisions.

11.Bullish:

Refers to the market’s perception that a specific event or news will have a positive impact on a currency’s exchange rate, leading to increased demand and a price rise.

12.Bearish:

Indicates the market’s perception that a particular event or news will negatively affect a currency’s exchange rate, resulting in reduced demand and a price decline.

13.Market Open:

The time at which financial markets begin trading each day, marking the start of the trading session.

14.Market Close:

The time at which financial markets end their trading activities for the day, marking the end of the trading session. After the closing, buyers and sellers cannot execute trades, and the day’s closing price is determined.

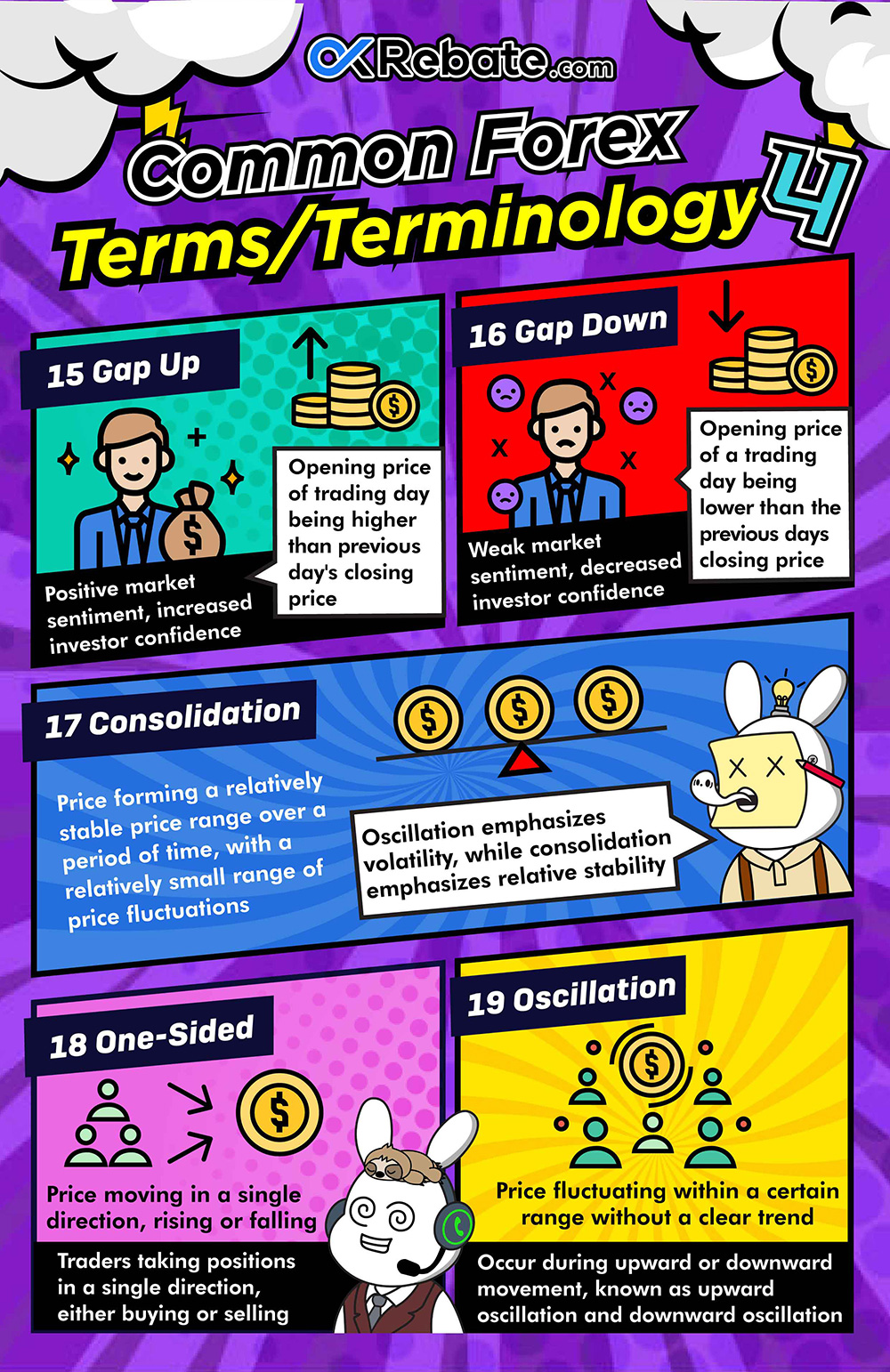

15.Gap Up:

Occurs when the opening price for a trading day is higher than the previous day’s closing price. It is often considered a bullish signal, indicating positive market sentiment.

16.Gap Down:

Occurs when the opening price for a trading day is lower than the previous day’s closing price. It is often considered a bearish signal, indicating negative market sentiment.

17.One-Sided:

Refers to a situation in which prices consistently move in the same direction, or traders predominantly take either long or short positions.

18.Oscillation:

Oscillation typically refers to price fluctuations occurring within a specific range without a clear trend. Oscillation can also occur during both upward and downward price movements, known as upward oscillation and downward oscillation.

19.Consolidation:

Consolidation refers to a period when prices form a relatively stable price range over a certain duration, with relatively small price fluctuations. Consolidation often follows significant price volatility, as market participants adopt a wait-and-see approach for new price trends. (Oscillation emphasizes volatility, while consolidation underscores relative stability.)