2.4 What is a forex market maker?

What is a Market Maker?

A market maker is a trader in the financial markets who buys and sells securities, futures, or other financial instruments to provide liquidity. Market makers typically act as both buyers and sellers, offering immediate trading services to clients.

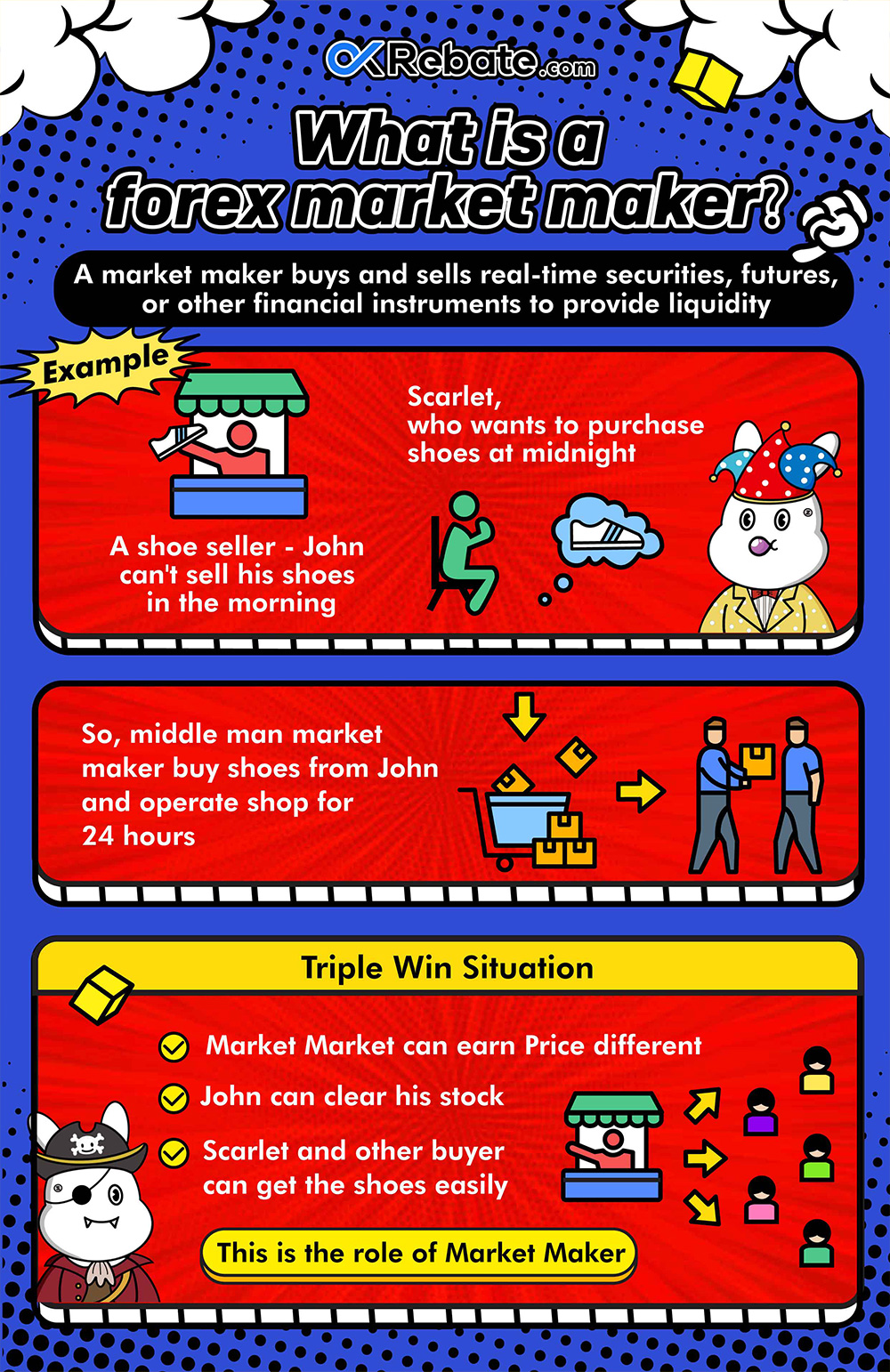

To understand this concept better, here’s a real-life analogy:

Imagine a person named Peter who sells shoes. Every day, he carries two boxes of shoes to the town square in the morning and tries to sell them. However, after half a day, nobody buys, so Peter goes back home in the afternoon. In the evening, Jessica decides she wants to buy shoes and goes to the town square but can’t find any shoe sellers. This situation arises because there wasn’t enough market liquidity (since shoes aren’t daily necessities), causing missed trading opportunities.

Observing this situation in town, a market maker named Tom steps in. The next morning, he buys all of Peter’s shoes at a slightly lower price and then sells them to Jessica in the evening at a slightly higher price. In this way, Peter easily sells his shoes, Jessica satisfies her need, and market maker Tom profits from the price difference. It’s a win-win for all three parties.

Later on, other sellers of various goods see this and join in. As trading liquidity increases, productivity also grows, and more market makers appear, handling a variety of goods. As villagers see the wider selection of goods in town, they become more willing to shop, leading to economic prosperity in the town.

So, what is a Forex market maker?

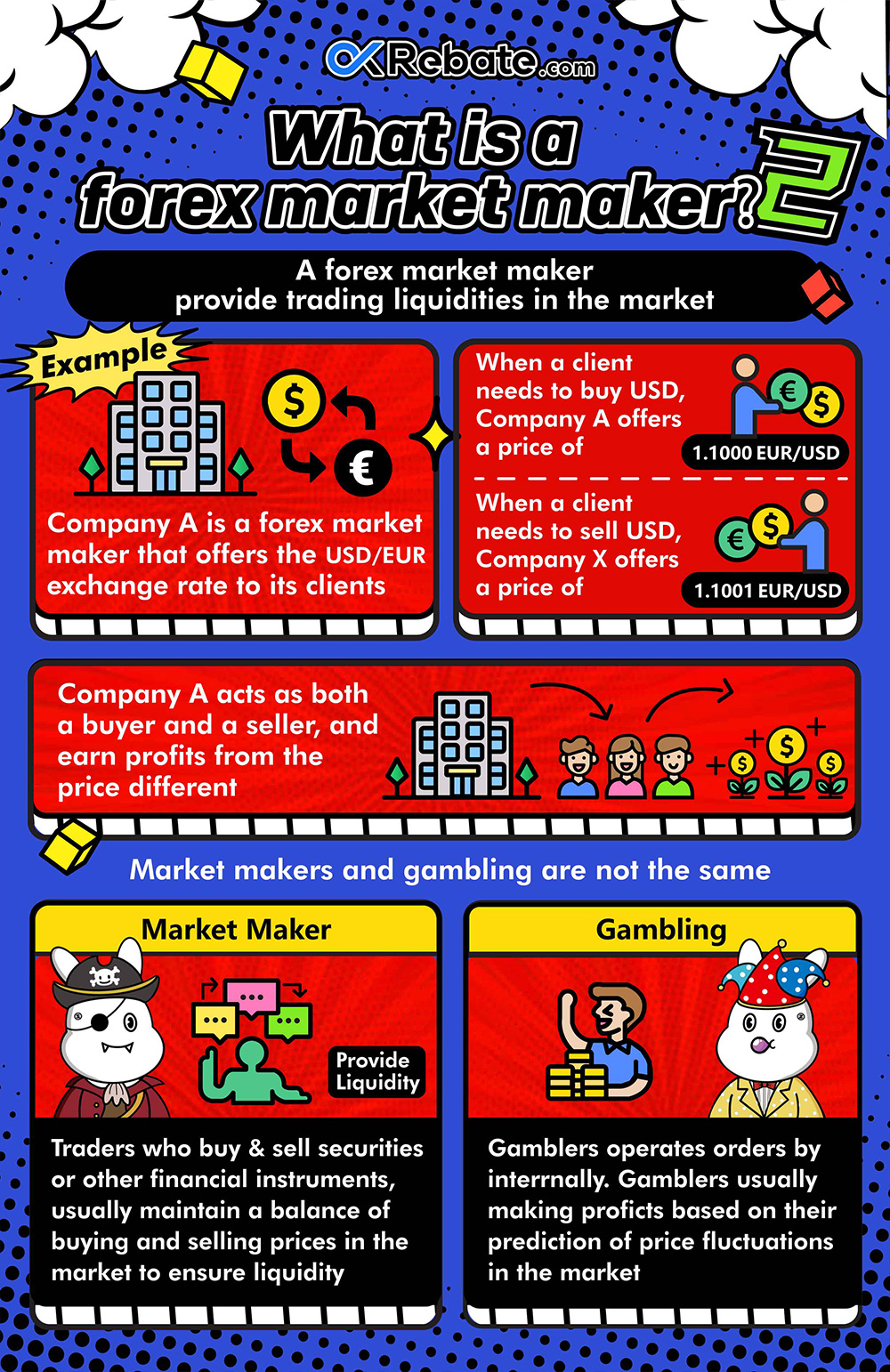

Applying the same logic, a Forex market maker is a trader who buys and sells currencies in the Forex market to provide liquidity.

For example, Company FOREX A is a Forex market maker that offers exchange rates for EUR/USD to its clients. When a client wants to buy USD, Company FOREX A offers a price of 1.1000 EUR/USD. When a client wants to sell USD, Company FOREX A provides a price of 1.1001 EUR/USD. Therefore, Company FOREX A acts as both a buyer and a seller, and the difference between the buy and sell prices is the profit earned by Company FOREX A and the reason for its involvement in this business.

Common misconception: Many beginners may believe that market maker platforms are dealing desk (DD) platforms. Are market makers and dealing desks the same thing?

Firstly, let’s make it clear: No, market makers and dealing desks are not the same concept.

A market maker is a trader who buys and sells securities or other financial instruments in the market to provide liquidity. They typically balance buy and sell prices in the market to ensure liquidity.

A dealing desk (DD) refers to trading in securities or other financial instruments with the aim of speculating on future price movements. Dealing desk traders often make trading decisions based on their expectations of price movements and seek to profit from market volatility.

Therefore, the purpose of market makers is to provide market liquidity, while dealing desk traders aim to speculate on market fluctuations.