2.3 Where do the Forex Broker price come from?

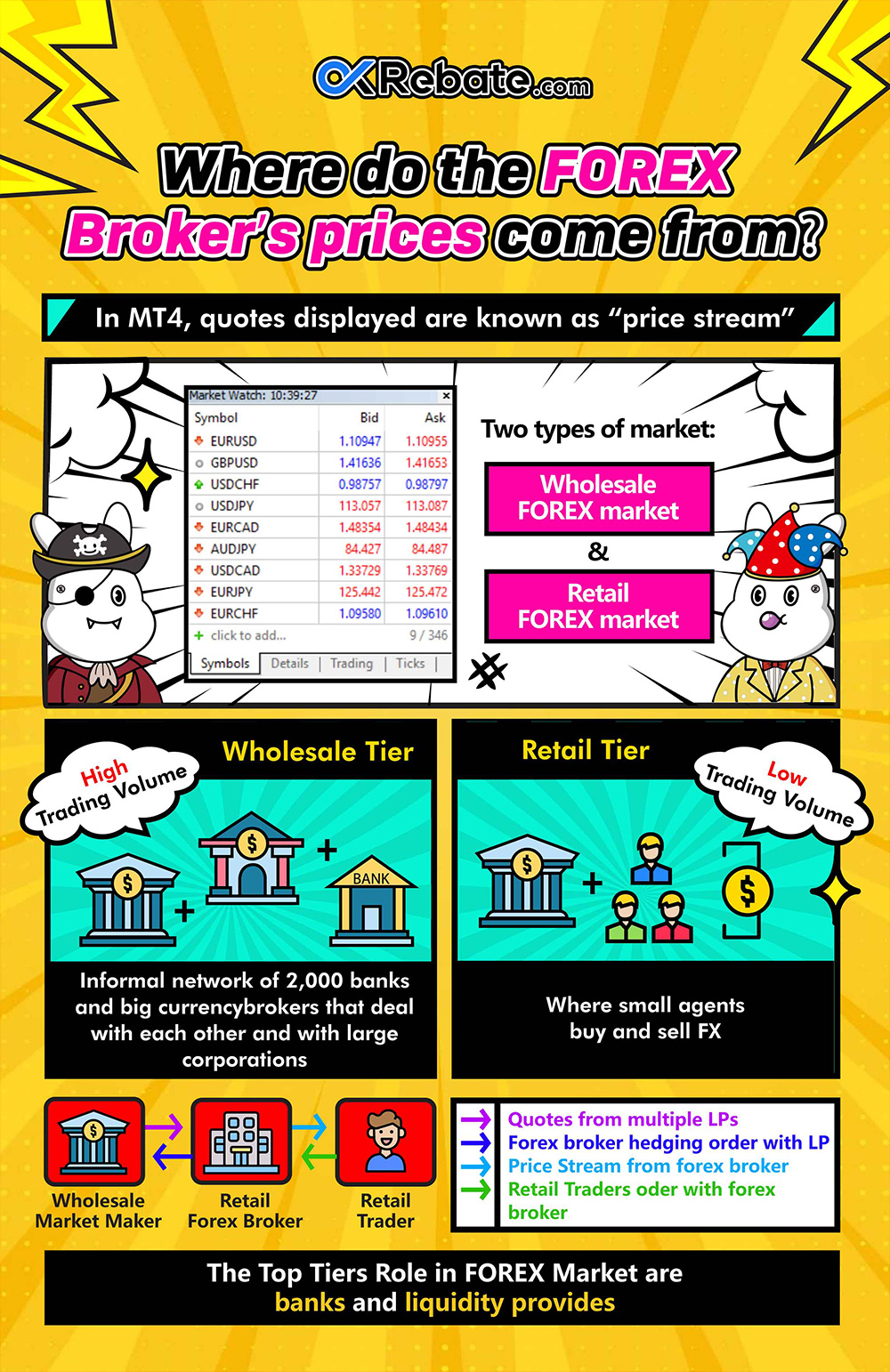

When you open market quotes in MT4, you’ll see prices for different trading instruments. But where do these prices originate? (In MT4, these displayed quotes are often referred to as “price feeds,” with the spread, i.e., the cost of trading, represented on the right as the difference between the bid and ask prices.)

Let’s first understand who the participants are in the retail Forex market from top to bottom:

Firstly, based on differences in Forex trading volumes, we can distinguish between the wholesale Forex market and the retail Forex market.

The wholesale Forex market involves large-scale trading and primarily comprises interbank transactions among banks. This also includes Forex transactions between banks and central banks, as well as transactions among various central banks.

The retail Forex market, on the other hand, deals with smaller trading volumes and primarily involves Forex transactions between banks and their clients. The trading volumes in this segment are generally relatively small.

Yes, you read that correctly – the term “retail market,” which implies smaller trading volumes, refers to transactions between banks and retail brokers, not directly between retail brokers and individual traders. Individual retail traders are clients of retail Forex brokers, and they are not directly connected to banks. In the Forex market, the real market participants are major banks and non-banking financial institutions at the top of the ecosystem.

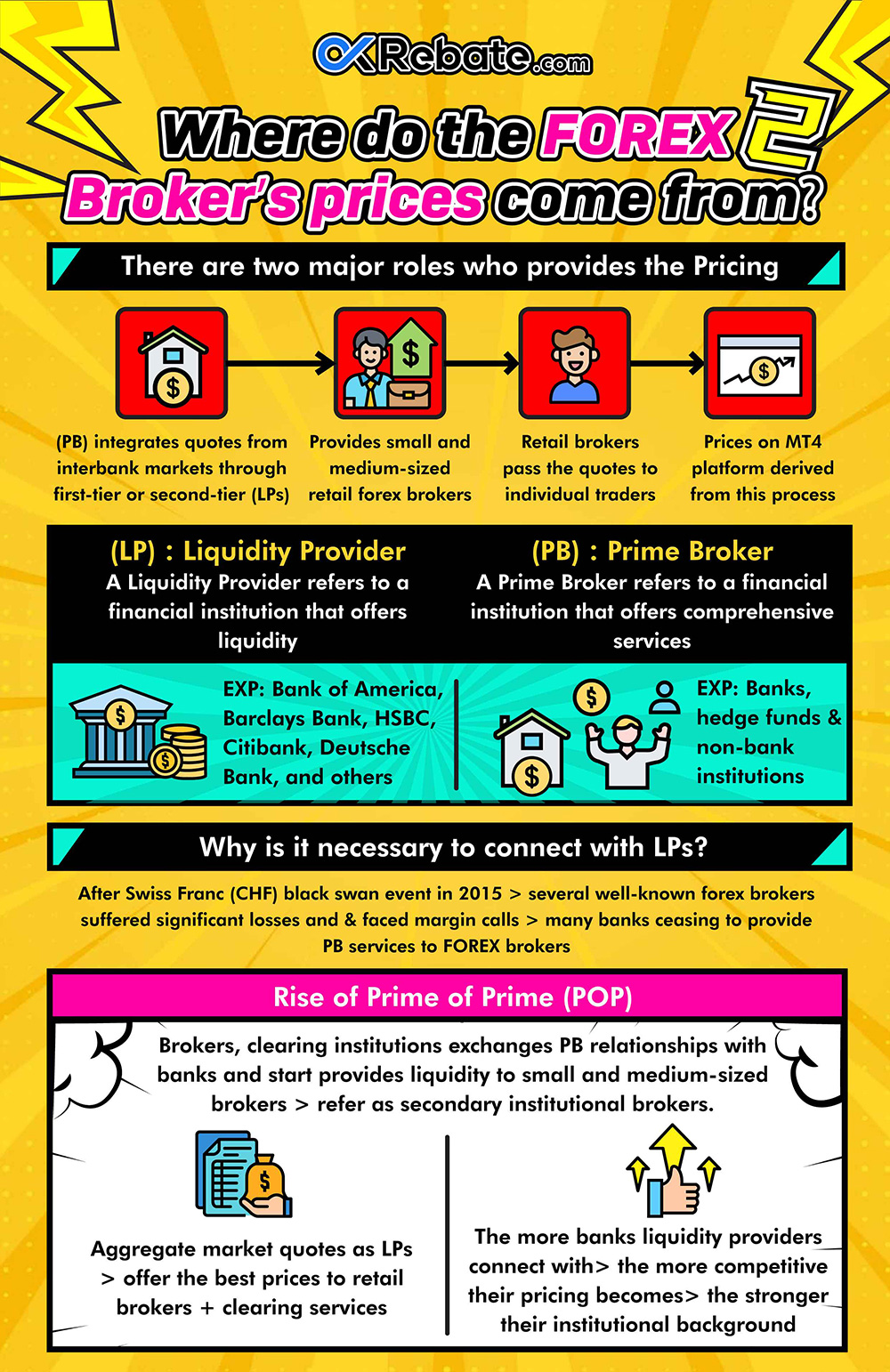

An explanation on LP and PB:

Liquidity Providers (LPs): LPs are financial institutions that provide liquidity. Top global LPs include Bank of America, Barclays Bank, BNP Paribas, Citibank, Deutsche Bank, Goldman Sachs, HSBC, JPMorgan Chase, Nomura Securities, Société Générale, and UBS, among others.

Prime Brokers (PBs): PBs are financial institutions that offer comprehensive services. Common PBs include banks, hedge funds, and non-bank institutions.

Some large banks act as both PBs and LPs.

Why is access to LPs necessary?

After the “Black Swan” event with the Swiss Franc in 2015, many well-known Forex brokers collectively experienced massive losses and “blew up” their accounts. This led several banks to stop offering Prime Broker (PB) services to Forex brokers.

As a result, only a few major banks now provide PB services globally. For small and medium-sized brokers, direct access to banks for liquidity is often not feasible. Therefore, a service called “Prime of Prime” (PoP) emerged. PoP providers, which include brokers, clearinghouses, and exchanges with PB relationships or access, offer liquidity to small and medium-sized brokers. These PoP providers, often referred to as secondary broker-dealers, consolidate market quotes and deliver the best prices to retail brokers while providing clearing services. The more banks and LPs a PoP provider can connect to, the more competitive their prices, and the stronger their institutional backing. Common liquidity providers in the market include CFH, ADS, CMC, and others.

In simple terms, a Prime Broker (PB) integrates quotes from interbank markets through first-tier or second-tier Liquidity Providers (LPs) and offers these quotes to small and medium-sized retail Forex brokers. Retail brokers then pass these quotes on to individual traders. This is the ultimate source of the prices you see in MT4. So, the prices offered by brokers originate from the interbank market.