2.2 4 Major reason to choose a forex broker

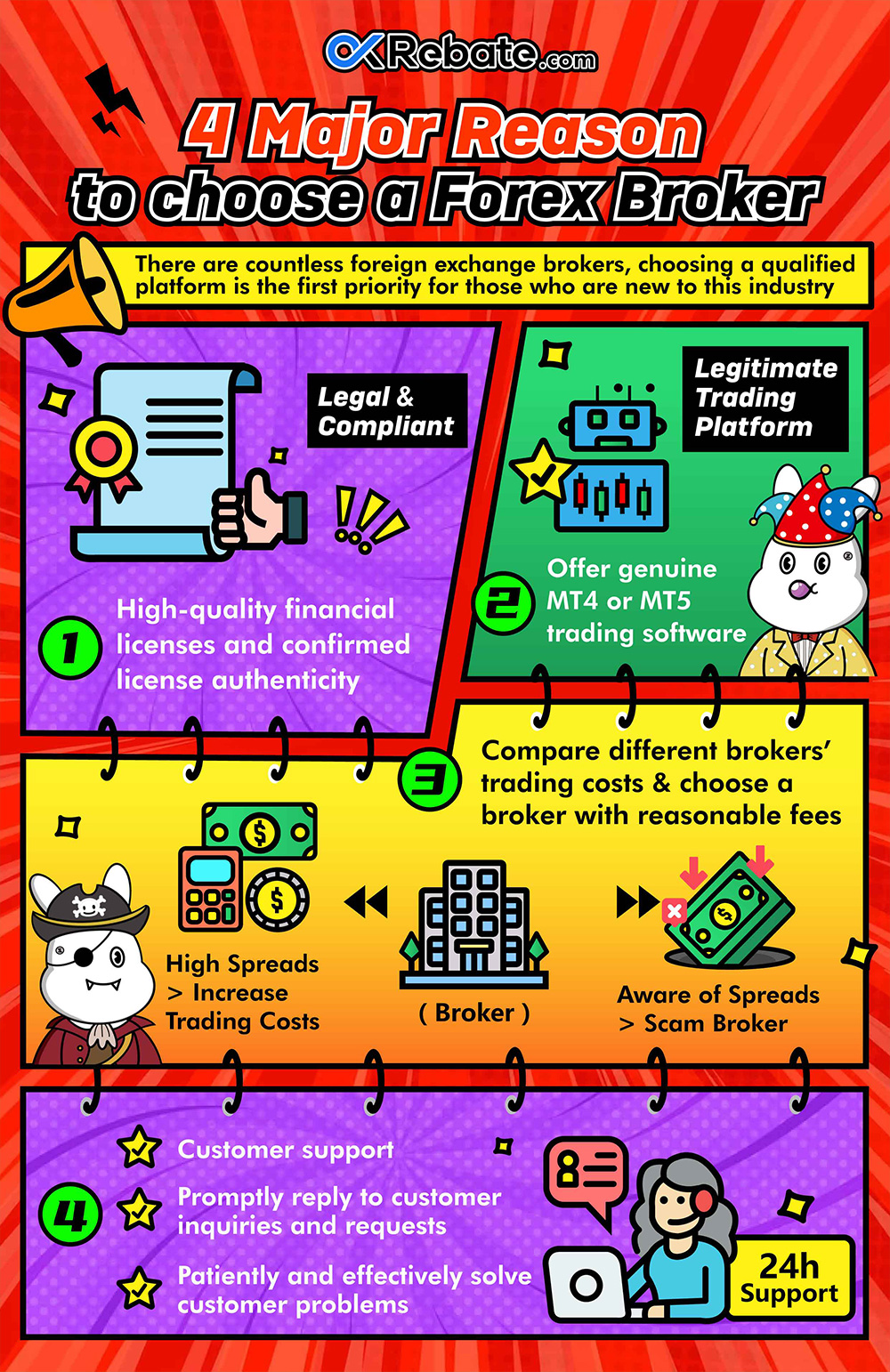

There are countless Forex brokers available, so selecting a reputable platform is your first task when entering this industry.

When choosing a Forex broker, pay attention to the following four points:

1. Ensure you choose a broker that is legal and compliant, with high-value financial licenses, and verify the authenticity of these licenses.

Typically, you can confirm the legitimacy of a Forex broker’s license in two steps:

First, visit the official website of the broker in question to determine which regulatory authorities oversee them and confirm the legitimacy of these regulatory bodies.

Second, Check the broker’s license number and verify its existence on the official website of the relevant government agency.

For example, if a platform claims to be regulated by FCA or ASIC (usually with a license number), you should visit the official websites of FCA or ASIC, search for the license number or broker’s name. If the broker’s regulation is legitimate, it will display detailed information about that broker. If no information is found, exercise caution.

2. Determine if they offer a legitimate trading platform:

Check if the broker provides authentic MT4 or MT5 trading software. Some illegitimate brokers create counterfeit MT4 platforms to deceive investors into depositing funds. For reference, visit the official MetaQuotes website: https://www.metaquotes.net/

After logging into your account, ensure that the platform is stable, secure, and user-friendly. Observe if it experiences frequent freezes or malicious slippage.

3. Compare the trading costs among different brokers and select one with reasonable fees.

Excessively high spreads can increase trading costs for investors, while extremely low spreads may raise questions about the platform’s legitimacy. Operating a trading platform incurs expenses, and revenue is typically generated through transaction fees. Consider whether a platform offering zero trading costs is truly acting in your best interest.

Over time, the industry has become more transparent, with significant liquidity in the Forex market. Competition among Forex brokers has driven down trading costs. For instance, even with relatively high trading costs, the spread for EUR/USD rarely exceeds 2 pips. Therefore, selecting a broker with reasonable fees is sufficient.

4. Do they provide customer support? Ensure there is a fast and effective support channel.

Does the broker offer 24/7 customer support? Are they prompt in responding to customer queries and requests? Are they patient and effective in resolving customer issues?

Insufficient customer support can potentially impact trading efficiency and satisfaction. Thus, this aspect is of utmost importance.

Common Questions About Forex Brokers:

1. Why does a Forex platform have multiple regulatory licenses?

Firstly, Forex platforms often acquire multiple regulatory licenses to expand their operational scope and provide more protection to their clients. If a Forex platform has only one regulatory license, it can only offer services within the jurisdiction covered by that license. Therefore, obtaining multiple licenses allows a Forex platform to extend its service range and attract more clients.

2. Different regulatory licenses typically represent varying regulatory standards and requirements.

Having multiple licenses can enable a platform to offer a wider range of product and service options to clients. It also demonstrates that the platform has passed scrutiny from multiple regulatory authorities, which enhances clients’ trust in the platform. For example, ASIC in Australia imposes a maximum leverage of 30:1, but if a broker holds both an ASIC license and a license from another jurisdiction that allows 500:1 leverage, it can cater to clients with different leverage preferences while benefiting from the credibility of a major license.

In summary, Forex platforms obtain multiple regulatory licenses to offer a broader range of products and services, attract more clients, enhance client trust, and protect client interests.