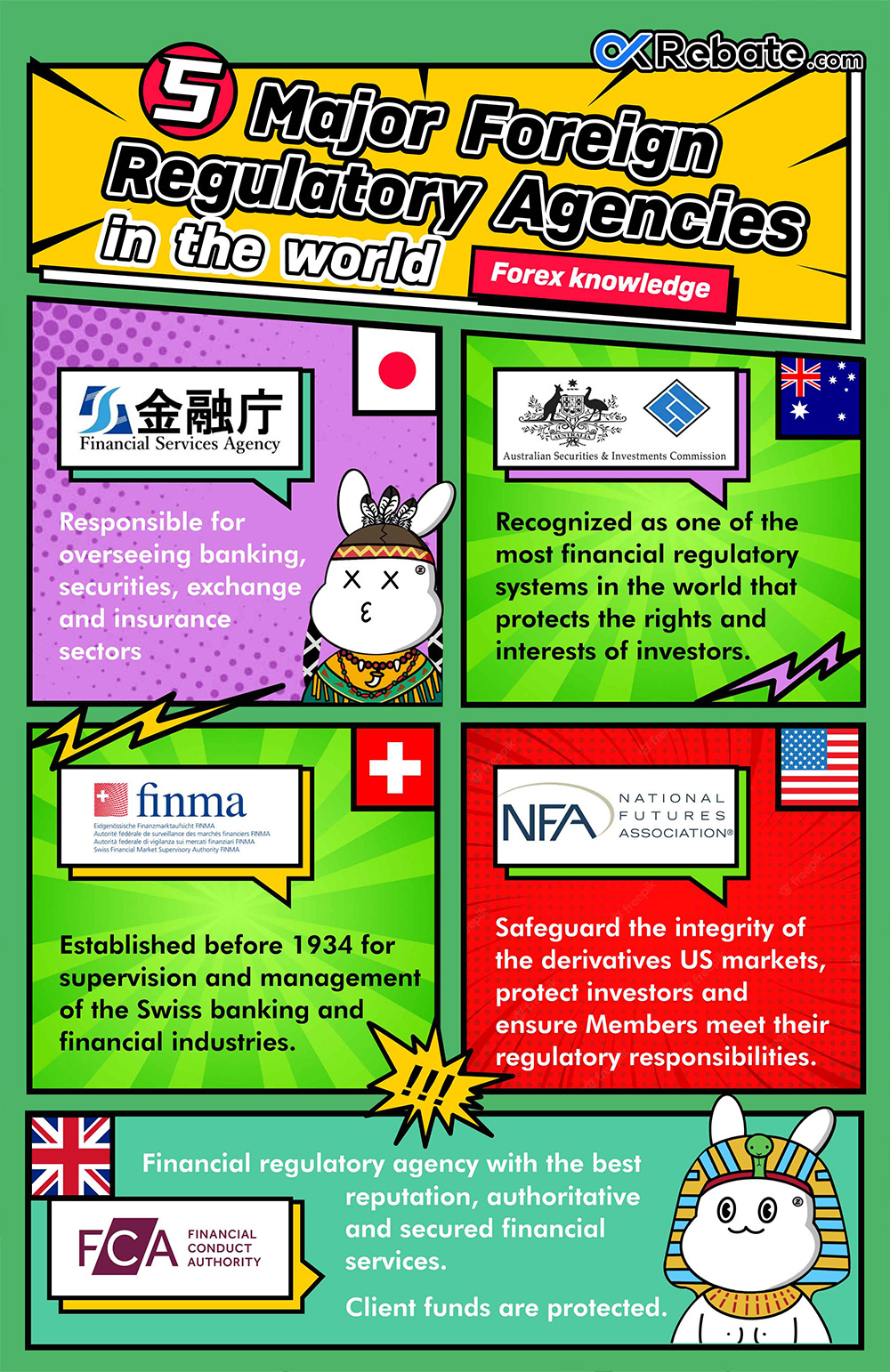

2.1 5 Major Foreign Regulatory Agencies in the world

Summary: Regulatory authorities play a crucial role in safeguarding the interests of investors and maintaining market stability in the Forex industry. Therefore, before embarking on the journey of trading, it is essential to learn how to identify the compliance of brokers, gain knowledge about regulatory bodies, and enhance self-protection awareness.

What is the Purpose of Forex Regulation, and What Does Regulatory Authorities Mainly Oversee?

- Ensuring the legal operation of Forex trading institutions and compliance with relevant laws and regulations.

- Regulating trading order in the Forex market to ensure fairness and transparency in the trading process.

- Safeguarding the security and rights of investors, ensuring they receive equitable treatment in trading.

Let’s take a closer look at some of the world’s most authoritative regulatory authorities:

FCA (Financial Conduct Authority, United Kingdom)

The United Kingdom is renowned for having one of the most comprehensive, robust, and stringent financial service sectors.

FCA is the financial regulatory body in the UK, established in 2013. It is responsible for overseeing the UK’s financial markets to ensure market fairness, consumer protection, and financial stability.

FCA regulates banks, insurance companies, securities brokers, and other financial institutions, ensuring their compliance with laws and regulatory rules while providing consumers with fair financial services. FCA also addresses market issues and corrects improper behavior through complaint resolution and regulatory procedures.

ASIC (Australian Securities & Investments Commission, Australia)

ASIC is an independent government agency in Australia, founded in 1991. Its primary responsibility is to regulate Australia’s securities and financial markets to ensure market fairness, protect the rights of investors and consumers, and maintain financial stability.

ASIC regulates banks, insurance companies, securities brokers, corporations, and other financial institutions in Australia, ensuring their compliance with laws and regulatory rules while providing investors and consumers with fair financial services. ASIC is recognized as one of the world’s most investor-friendly financial regulatory systems.

NFA (National Futures Association, United States)

NFA is a nonprofit futures regulatory organization in the United States, established in 1982. Its primary role is to oversee the U.S. futures markets to ensure a fair, honest, and transparent trading environment and protect the interests of investors. NFA manages futures brokers and traders, monitoring their conduct. It also maintains a set of rules requiring futures brokers to disclose financial information, adhere to risk management requirements, and strictly enforce customer fund regulations.

FSAJ (Financial Services Agency of Japan, Japan)

The Financial Services Agency of Japan is an independent government agency in Japan, established in 2000, which regulates banks, insurance companies, securities brokers, and other financial institutions. Its primary responsibility is to oversee Japan’s financial markets to ensure market fairness, protect investor rights, and maintain financial stability.

FINMA (Swiss Financial Market Supervisory Authority, Switzerland)

FINMA is an independent regulatory authority in Switzerland, founded in 2007. FINMA is responsible for regulating Switzerland’s financial markets, including banks, insurance companies, securities brokers, and other financial institutions, to ensure market fairness, protect investor rights, and maintain financial stability.Due to the multitude of regulatory bodies globally, if you prefer not to spend excessive time researching, it is advisable to prioritize Forex platforms that hold the aforementioned licenses. Considering the vast array of global regulatory bodies, even experienced investors may struggle to decipher the intricacies of regulatory frameworks. Therefore, when selecting a broker, it is recommended to opt for those regulated in financially developed regions, as more developed financial regions tend to have stricter regulations and relatively higher security standards.