1.6 MT4 Trading Type

In MT4, there are two types of trading: market execution and pending orders. Let’s discuss each of them:

Market Execution, also known as market orders, involves opening a position at the current market price. Market execution is straightforward. When a trader anticipates that the price of an asset will rise, they can simply click “buy” or “sell,” and the order will be executed immediately at the current market price (plus the spread).

Pending Orders: These are orders executed when specific conditions are met. For example, when a trader wants to enter a position at a favorable price but the current price is far from their desired level, and they don’t want to monitor the market continuously, they can place a pending order with a predetermined price. When the market reaches the set price, the pending order is automatically triggered.

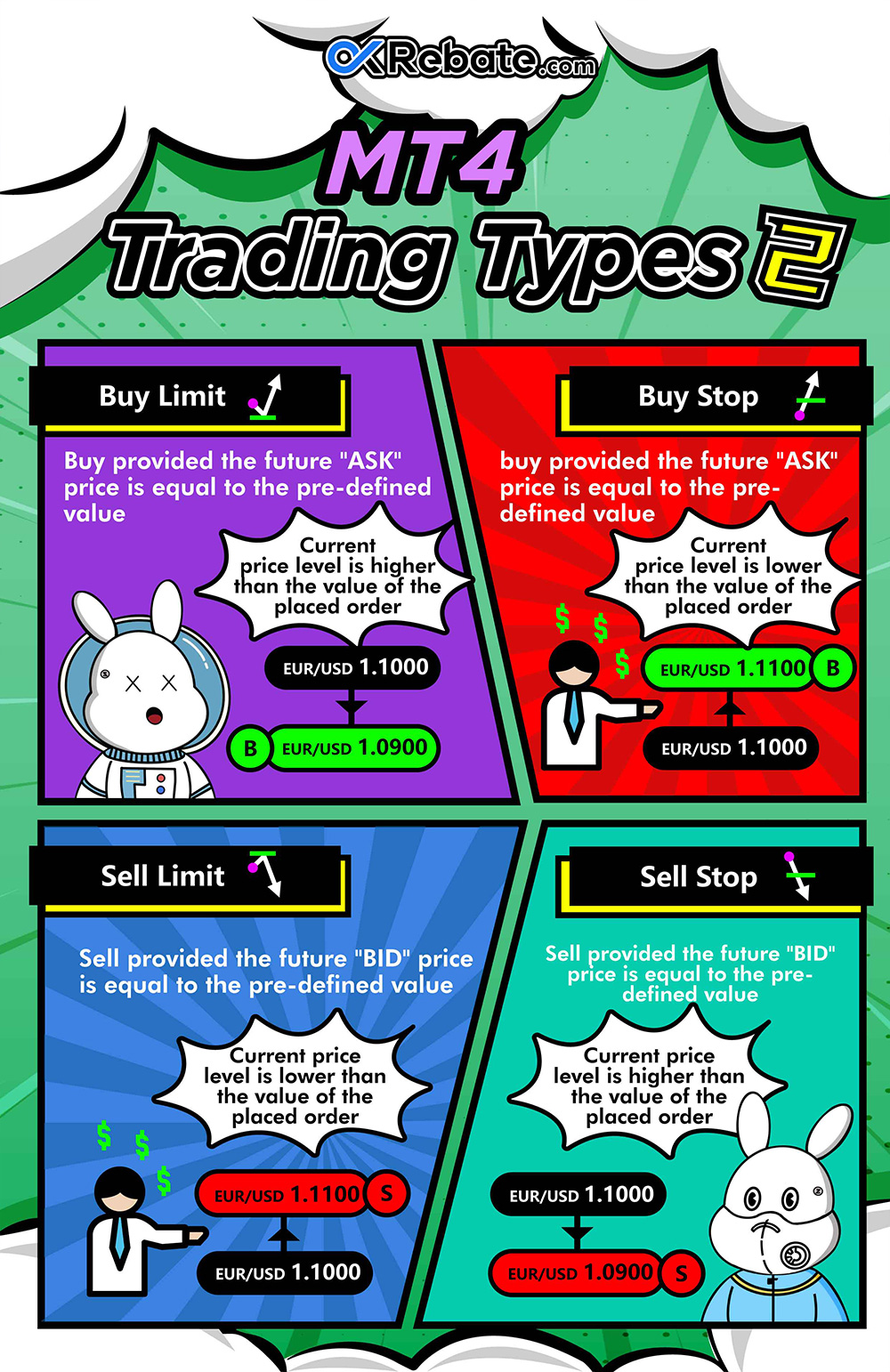

Pending orders can be further divided into four types:

- Buy Limit: Buy limit orders are typically used when prices are expected to drop before rising. The buy price set in this mode must be lower than the current market price. For instance, if the current EUR/USD price is 1.1000, and a trader wants to go long when it drops below 1.0900, they would use a buy limit order.

- Buy Stop: Buy stop orders are usually employed when prices are expected to continue rising. The buy price set in this mode must be higher than the current market price. For instance, if the current EUR/USD price is 1.1000, and a trader wants to go long when it rises above 1.1100, they would use a buy stop order.

- Sell Limit: Sell limit orders are typically used when prices are expected to rise before falling. The sell price set in this mode must be higher than the current market price. For instance, if the current EUR/USD price is 1.1000, and a trader wants to go short when it rises above 1.1100, they would use a sell limit order.

- Sell Stop: Sell stop orders are usually employed when prices are expected to continue falling. The sell price set in this mode must be lower than the current market price. For instance, if the current EUR/USD price is 1.1000, and a trader wants to go short when it drops below 1.0900, they would use a sell stop order.

In summary, these four pending order types can be understood as follows:

Orders with “limit” are used for trend reversals, either buying at lows or selling at highs.

Orders with “stop” are used for trend continuations, either chasing longs or shorts.

Additionally, traders can set expiry times for their pending orders based on their specific requirements. To conclude, the main difference between market orders and pending orders is how they are executed. Market orders are executed immediately, while pending orders are executed when specific conditions are met.

Pros and cons of market execution and pending orders:

Market execution is convenient and fast, as it doesn’t require complex price parameter settings or predictions. However, it may be challenging to get the best entry point, especially in volatile markets, and can result in slippage. High-frequency traders often use market execution.

On the other hand, pending orders allow traders to save time and enter positions at desired prices. However, if the pending order price is too far from the current market price, it may not be triggered, potentially causing missed profit opportunities. Traders need to have precise price expectations when using pending orders.